Happy 10th Birthday KiwiSaver

Background

I can remember the excitement and uncertainty when discussing KiwiSaver with investors back in 2007. Many investors were a bit uneasy with KiwiSaver and with the responsible entity behind KiwiSaver, the Government. There were comments such as “I have seen this before, great until they change their minds again and close it down”.

Well, 10 years on and KiwiSaver is still here! Not only is it here, but it is in a strong position. KiwiSaver now has over $40 billion funds under management with over 2.5 million investors. $40,000,000,000 looks and sounds impressive, right?

Even with this success, KiwiSaver investors should make better use out of this retirement savings scheme by saving more and making sure they are invested in an appropriate fund. KiwiSaver is a voluntary scheme which allows its investors to take contribution holidays and / or to be automatically enrolled in default funds, which are the most defensive of funds and not necessarily the most appropriate funds for all investors. Many KiwiSaver investors are only contributing 3% of their gross salaries. For a comparison, let’s see how KiwiSaver stacks up to the Australian superannuation experience.

Australia made their superannuation scheme mandatory in 1992 and now it has a market value of over $2,842 billion ($2.8 trillion rounded) and is celebrating its 25th Birthday (as a mandatory scheme). Australians currently contribute 9.5% of their salaries (since 1/7/2014) and it is planned for that to increase to 12% starting in 2021 through to 2025.

As a simple comparison, if we adjust for the difference in populations and use 19% to approximate New Zealand’s population, in the 10th year of the Australian scheme, the market value would have been approximately $138 billion (vs. $40 billion in KiwiSaver). Ouch, we still have some heavy lifting to do. Yes, Australia is a larger country with over 5 times as many people but as long as KiwiSaver is a voluntary retirement scheme with a 3% minimum employee contribution rate, it is going to be a very uphill battle for some retirees!

Retirement

What is retirement and how will you define it? Retirement is different things for different people. How much will it cost, how much will I/we need to survive? Here are some facts that might help start you thinking.

Approximately 80% of all people aged 65+ live in households of one and two persons according to data from the 2013 census.

Actual weekly retirement expenditures as per the New Zealand Retirement Expenditure Guidelines 2015 for a two-person household – Choices Option[2]

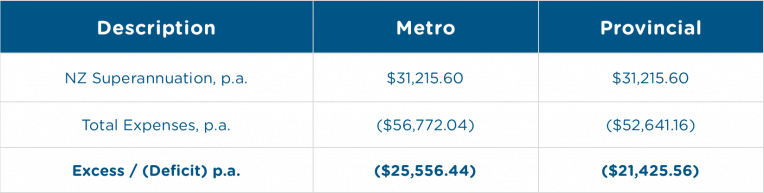

New Zealand Superannuation, for a couple and who both qualify equals $600.30 each, for a total of $1,200.60 per fortnight which equates to $31,215.60 per annum[3]

The Excess / (Deficit) as follows:

The deficit must be funded by the retirees’ savings, (i.e. KiwiSaver). This deficit must be met not just in one year, but in every year of retirement (a conservative assumption).

At Lifetime, we use a sophisticated retirement model in IRESS’s XPlan. Here is a basic retirement model example which shows how much would be required (i.e. lump sum value today) in the couples combined KiwiSaver accounts, to allow the couple to retire today and fund the ($25,556.44) annual retirement deficit.

XPlan Retirement Model:

Retirement model assumptions and output:

- both age 65 today and retire this year.

- Income = NZ Superannuation only, (currently $31,215.60 for couple).

- Expenses, assume the metro expense of $56,772.04 (as stated above).

- Deficit / portfolio draw-down of ($25,556.44) deficit for the next 25 years (life expectancy plus 3 years = age 90).

- Invests in a Balanced Fund (roughly 6% net return after all fees and taxes).

- Weekly Retirement expenses of $1,091.72, per the table on page 2, is a very baseline guide to expenses. Any large or regular travel plans, large purchases or home repairs would need additional funding.

Required KiwiSaver balances at retirement = $500,000 for a couple!

Conclusions

In my opinion KiwiSaver has done well in its first 10 years. Looking forward to the next 10 years, I would like to see some fine-tuning such as increasing the minimum contribution rate and for the Government to introduce further tax incentives to help us save more.

There is a strong case to make the KiwiSaver scheme mandatory.

As a KiwiSaver investor you can increase your employee contributions now, this is voluntary.

It is a good idea to have a retirement plan in-place before you retire so that you can understand your specific financial situation. You should have all the facts and estimates before you make any big decision, this is just good practice. Lifetime advisers can help you with this.

As always, when in doubt, speak to your financial adviser.

Article by Joe Byrne, BA, AFA - Read more

[1] Source: 2013 Census QuickStats about people 65 and over. Statistics NZ (available from http://www.stats.govt.nz/Census/2013-census/profile-and-sum-mary-reports/quickstats-65-plus.aspx)

[2] This 2015 research paper was a joint project between Workplace Savings NZ and The Fin-Ed Centre (a joint initiative between Westpac and Massey University). The expenses represent a more comfortable standard of living, which includes some luxuries or treats as opposed to the no frills level. This is based on average expenditure of the fourth quintile of the HES for retired households, 2013 income ranges from $56,900 to $101,800.

[3] New Zealand maximum payment rates for Superannuation on tax code M, https://www.workandincome.govt.nz/eligibility/seniors/superannuation/payment-rates.html

Lifetime Book Club: Die With Zero by Bill Perkins

“The goal is not to die with the most money, but to live the richest life.”

That is the central idea of Die With Zero. From the start, Perkins makes it clear this is not a book about saving, investing, or retiring early. It is about using money, time, and health to create a meaningful life now, not someday.

The Rise of Ethical Investing

Ethical investment, also known as Socially Responsible or ESG (Environmental, Social, Governance) investment, is about putting your money where your values are. These investments allow you to support companies and industries that aim to make a positive impact, whether that’s reducing carbon emissions, promoting fair treatment of workers, or driving social change.