Investing vs. Speculating

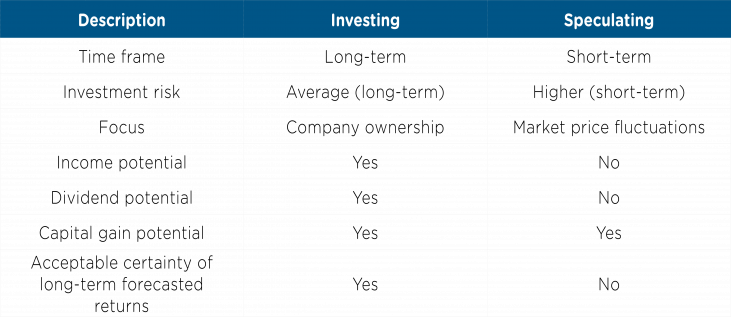

Bitcoin is the latest ‘hot’ trend but is it worth investing in? With any investment opportunity, it is important to make the distinction between investing and speculating. In simple terms, speculators are trying to out-smart the markets while investors simply participate in the markets. The investment time horizon is also a very important factor as speculation tends to be over the short-term while investing is over the long-term.

Speculating is purchasing an asset to capitalise on market inefficiencies, in the hope it will become more valuable at a future date. It is an attempt to profit from a short-term market move rather than attempting to profit from the underlying financial attributes of the asset, such as dividends, interest income or capital gains.

Warren Buffet is regarded as one of the most respected investors of our generation. He was inspired by the work of Professor Benjamin Graham of the Columbia Business School in New York City. Professor Benjamin Graham, along with Professor David Dodd, attempted a precise definition of investing and speculating in their seminal work Security Analysis (1934).

“An investment operation is one which, upon thorough analysis, promises safety of principal and a satisfactory return. Operations not meeting these requirements are speculative”.

Bitcoin is a very hotly discussed topic in the financial press these days. A question that keeps coming up; is this a good investment or is this just media hype built on speculation?

Here is a good summation of Bitcoin from Platinum International’s December 2017 quarterly report;

“Some argue that the structure of Bitcoin is an exact replica of a Ponzi Scheme. Nobody can see Bitcoin or make anything out of it and there is no utility value holding Bitcoin (unlike, say gold, which is used to make jewellery and has some limited industrial uses). Bitcoin generates no income, and an owner of Bitcoin can only make money by selling the Bitcoin at a higher price to another investor. Bitcoin buyers are attracted by the very high appreciation apparently on offer, and the continuation of the scheme is dependent upon current holders continuing to hold. Encouraging holding, there are some barriers to moving Bitcoin held off an exchange onto an exchange, such as slow transaction time and high transaction costs, making selling difficult. To cap things off, the whole process is facilitated by the exchanges, which act as a cashed-up manager of the scheme, pumping out unregulated advertising promoting the wonderful returns on offer.

The Future of Bitcoin is unclear, but it is unlikely to become a medium of exchange in its current form, and further regulation is likely on the horizon.”

In addition to the above listed failings, the future of Bitcoin is dependent on future regulation which therefore puts Bitcoin firmly into the ‘Speculation’ camp and therefore not part of the Lifetime Investment offerings.

Investment Philosophy

Lifetime has adopted an evidenced based, risk managed investment philosophy. This means we look to gain market access in a cost-effective manner whilst limiting the amount of risk our clients take. We look at both the risk and return side of the equation for our investors, and do not follow a ‘returns at any cost’ philosophy (which rules out Bitcoin). Our job is to ensure our investors are adequately compensated for the investment risks they take, which is the essence of Modern Portfolio Theory.

It is our job at Lifetime to make sure our clients are comfortable with how their portfolios are being invested, in-line with their values and beliefs.

If you have any questions regarding this, or your investment portfolio, please speak to your financial adviser.

Lifetime Book Club: Die With Zero by Bill Perkins

“The goal is not to die with the most money, but to live the richest life.”

That is the central idea of Die With Zero. From the start, Perkins makes it clear this is not a book about saving, investing, or retiring early. It is about using money, time, and health to create a meaningful life now, not someday.

The Rise of Ethical Investing

Ethical investment, also known as Socially Responsible or ESG (Environmental, Social, Governance) investment, is about putting your money where your values are. These investments allow you to support companies and industries that aim to make a positive impact, whether that’s reducing carbon emissions, promoting fair treatment of workers, or driving social change.