Investment Basics - Keep it simple

Having been a fixed interest trader dealing in hundreds of millions of dollars of bonds, futures and other derivatives, I had to be adept in my investment analysis. As a trader, I was proud of my ability to handle ‘complexity’. To be a successful financial adviser, I realised I would have to simplify investing for my clients.

I have had the benefit of both worlds. I can understand and interpret the complexity of the markets but can then get the message across to the clients of Lifetime in a simple way.

Income vs. Growth Assets

Investment markets are very complicated, so I tell my clients that we just need to focus on getting one thing correct and that is how much growth assets are in your portfolio. At the highest level, an investment portfolio breaks down into two major categories, Income and Growth Assets.

Income Assets are more defensive assets which consist of cash, cash-like investments, term-deposits and bonds. These assets have lower investment risk and therefore lower return yields as compared to growth assets. These are the assets that anchor the portfolio in a storm.

Growth Assets consist of shares and listed property. These are the assets that drive the investment return. Growth assets have much more investment risk as compared to income assets but have much higher forecasted returns.

Asset Allocation

The most important question that all investors need to ask is, what percentage of growth assets should they have in their portfolio and we refer to this as your asset allocation. A famous US academic study, referred to as the Brinson Study, estimated that approximately 94% of US Mutual Funds’ performance was driven by the funds’ asset allocation. Lifetime believes asset allocation to be the single most important factor and what we must focus on with our clients.

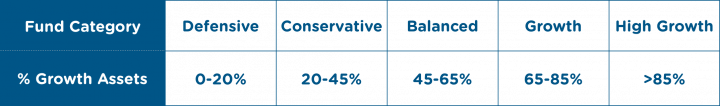

The percentage of growth assets in your portfolio will determine the risk and return characteristics of the portfolio. There are generally five broad classifications of funds, driven by the percentage of growth assets they have. They are as follows:

Risk Tolerance

Your risk tolerance is a way of linking up the amount of investment risk with what would be considered acceptable to you based on your attitude and capacity towards risk. Your risk tolerance is just a starting point that your financial adviser will use in trying to determine what percentage of growth assets is appropriate for your personal circumstances.

For example, in an ideal world, your risk tolerance score of a ‘Balanced Investor’ and investing in a balanced fund would allow you to achieve your investment or retirement goals.

Goal and Objectives

Unfortunately, sometimes investors need to take on more investment risk than what their risk tolerance suggests as appropriate. It is a choice the investors have. To achieve their goals they need more money, so they must take on greater investment risk or they may decide to invest in-line with their risk tolerance and reduce their retirement objectives. Our financial advisers are trained to point out these decisions and explain the pros and cons of these decisions to our clients.

Conclusion

Keep it simple – Growth Assets are very important. The Brinson study highlights how important growth assets are to your investment portfolio. Your financial adviser can help you figure out how much ‘Growth Assets’ should be in your portfolio.

It is our job at Lifetime to make sure our clients are comfortable with how their funds are being invested, in-line with their values and beliefs.

If you have any questions and would like to discuss this further, please speak to your financial adviser.

Lifetime Book Club: Die With Zero by Bill Perkins

“The goal is not to die with the most money, but to live the richest life.”

That is the central idea of Die With Zero. From the start, Perkins makes it clear this is not a book about saving, investing, or retiring early. It is about using money, time, and health to create a meaningful life now, not someday.

The Rise of Ethical Investing

Ethical investment, also known as Socially Responsible or ESG (Environmental, Social, Governance) investment, is about putting your money where your values are. These investments allow you to support companies and industries that aim to make a positive impact, whether that’s reducing carbon emissions, promoting fair treatment of workers, or driving social change.