Investment Update November 2018 - A Holiday Perspective

Those who have been following share markets will know that returns during 2018 have been more variable (both up and down) than in the few years prior, which were unusually smooth.

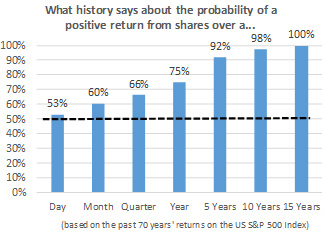

With plenty happening during the year, the temptation to keep a very close eye on investment returns is high. At first glance it might therefore seem a little worrying that only just over half of the days this year have delivered a positive return for shares. But this is exactly in line with history. Over the past 70 years, ‘only’ 53% of days have seen a market rise. Put another way, when you look at the share market on any given day, whether it’s gone up or down is pretty much a coin toss.

Put that together with our emotional tendency as humans to feel twice as much pain from a loss as we do pleasure from a gain. It is then clear that someone who checks their investment balance every day is not going to have a very pleasant time!

It gets better though. Despite ‘only’ rising on 53% of days, someone who just checked in annually would have seen a positive return 75% of the time. This rises to 98% of 10-year periods and all 15-year periods, reaffirming that most short-term returns are ‘noise’ for someone with a long timeframe.

In investing, like in many things in life, the best way to have a good experience is to have the right perspective.

In investing, like in many things in life, the best way to have a good experience is to have the right perspective. Thinking about it this way, long-term saving, and investing has some similarities to going on holiday. When you have packed up and headed out on the road to your destination, if you run into roadworks on the way, you are unlikely to respond by turning the car around. And when you get there, with glass of wine in hand, you probably will not call the cattery or dog kennel each day to see how the pets are getting on either.

So, feel free to sit back this summer – if your investment approach (or retirement plan) has been designed with your financial adviser to be in line with your timeframe, goals and ability to ride out shorter term ups and downs, then your portfolio will thank you for it.

Article by Joe Byrne, BA, AFA - Read More

Disclaimer: This article has been prepared for the purpose of providing general information, without taking into consideration any particular investor’s objectives, financial situation or needs. Any opinions contained in it are held as at the report date and are subject to change without notice. This document is solely for the use of the party to whom it is provided.

KiwiSaver is changing

Budget 2025 has introduced some significant updates to KiwiSaver. These changes are aimed at ensuring the scheme remains sustainable while helping New Zealanders grow their retirement savings. Whether you are just starting out, nearing retirement, or somewhere in between, here's what you need to know and how it might affect your financial plans.

Lifetime Book Club: Four Thousand Weeks by Oliver Burkeman

In a world obsessed with productivity hacks, endless to-do lists and squeezing more out of every day, Burkeman offers something radical: acceptance. Not of defeat – but of reality. Because when you really look at it, four thousand weeks (roughly 80 years) is all we’ve got. And no app or bullet journal is going to give us more.