History can show us the way

Those who cannot remember history, are condemned to repeat it.

- George Santayana, in The Life of Reason, 1905

I started writing my Newsletter Article this morning and wanted to cover the markets recent volatility. As I wrote I had a moment of Déjà vu, for I recalled already writing an article like this.

I went through my records and sure enough, a market volatility article written exactly two years ago. I only needed to modify the letter slightly, which you can see highlighted in bold text below.

Share-markets have gotten off to a rough start in 2018. The ups and downs (volatility) in share-markets can be quite unnerving and unsettling. Volatility can be caused by many things such as lower growth forecasts, lower profitability, social unrest, geopolitical events, higher inflationary expectations and just general uncertainty. Share-markets do not like uncertainty and that’s for sure.

Unfortunately, ‘Uncertainty’ and its first cousin, ‘Volatility’ are not new concepts, they have been around since the beginning of share-markets. Is the current correction a concern? Should you sell here? When faced with volatility, unprofessional investors are confronted with these types of questions and often make the wrong decisions. Let us help you answer those questions.

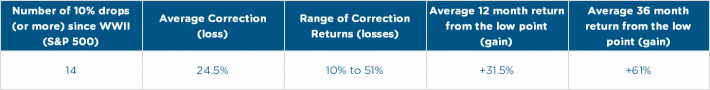

History can help answer these questions and show us the way, but only for those who are willing to look. Since the end of World War II, there have been 14 occasions (up until February 2016) where the largest share-market index in the world (America’s S&P 500) had a loss of 10% or more (a market correction). So in the last 70 years, there has been a market correction, on average, once every 5 years.

Let’s dig a little deeper. From the low point of these 14 corrections, the average return for the following 12 months was just over 30%. Wait, it gets better. The return from the low point for the following 36 months, on average, was just over 60%.

These 14 corrections were all caused by slightly different reasons, such as wars, oil embargos, credit crunches, recessions, asset bubbles and a currency crisis. Even though the reasons for the corrections were different, history shows us one thing is for certain – that the share-market will recover.

Conclusion

No, the sky is not falling and it is not the end of the world. Volatility is part of share-markets and it’s not always a negative. Volatility and share-market corrections can provide excellent buying opportunities. A famous saying from the world-renowned investor Warren Buffet goes something like this, “Be greedy when others are fearful.” Another favourite Buffet quote is when he is asked, what should an investor’s holding period be for a good company? Warren always responds by saying, “…for a lifetime.”

In this age of omnipresent news media, news presenters (and their editors) need to sell their programmes, newspapers and online advertising. Some tend to be sensationalists and need to make you believe this time is different, this time is special. Well, if we look to history, it paints a slightly different story. It tells me we have been here before, do not panic, be patient, the share-markets will recover.

In volatile times, it is important to stick to your long-term investment plan. However, you do need to let your adviser know if there have been any significant changes in your life or if you have a large purchase coming up. Significant changes can be reasons for your adviser to alter your investment plan.

If the recent volatility has been a serious concern, it might be a good time to update your risk tolerance profile with your adviser. Your adviser can then discuss your results with you and determine if your current investment portfolio is still appropriate for your current circumstances.

It is very important that if you do have any questions or concerns, that you contact your adviser.

Article by Joe Byrne, BA, AFA - Read More

Disclaimer: This article has been prepared for the purpose of providing general information, without taking into consideration any particular investor’s objectives, financial situation or needs. Any opinions contained in it are held as at the report date and are subject to change without notice. This document is solely for the use of the party to whom it is provided.

Lifetime Book Club: Die With Zero by Bill Perkins

“The goal is not to die with the most money, but to live the richest life.”

That is the central idea of Die With Zero. From the start, Perkins makes it clear this is not a book about saving, investing, or retiring early. It is about using money, time, and health to create a meaningful life now, not someday.

The Rise of Ethical Investing

Ethical investment, also known as Socially Responsible or ESG (Environmental, Social, Governance) investment, is about putting your money where your values are. These investments allow you to support companies and industries that aim to make a positive impact, whether that’s reducing carbon emissions, promoting fair treatment of workers, or driving social change.