General Election Update 2017

General Election Update 2017

By international standards, both National and Labour-led Governments appear relatively centralist, without large policy differences. While a Labour-led Government, may tend to be more fiscally liberal (willing to spend more) than a National-led Government, relative to global alternatives, the New Zealand economy is still likely to be considered relatively low risk, regardless of which party is in power.

The key issues of the 2017 Election have been framed as:

- Housing;

- Poverty;

- Inequality and

- Immigration

First NZ Capital believe under National, it would likely be the status quo, with the implementation of personal tax cuts, increased benefits and retaining a relatively open immigration policy.

Under Labour, taxes are likely to increase (maybe not in their first term), although current details are scant, immigration policies will likely tighten and fiscal spending would increase. Harbour Asset Management believes that a change to a Labour-led NZ Government may see a change in tax laws, which influence business and consumer confidence, and the willingness of business to make investment and employment decisions.

Changes to Labour policies, including the introduction of a living wage requirement, may impact on some companies with higher labour costs but could have positive impacts on the rest of the economy[1].

Labour has proposed a range of policies designed to dampen house price inflation. These include eliminating the use of tax losses on rental properties to offset their tax on other income, extending the bright line test from current two years to five years and a capital gains tax. Labour has also said it will ban foreigners from purchasing existing housing stock, with foreign demand instead channelled into new housing construction.[2]

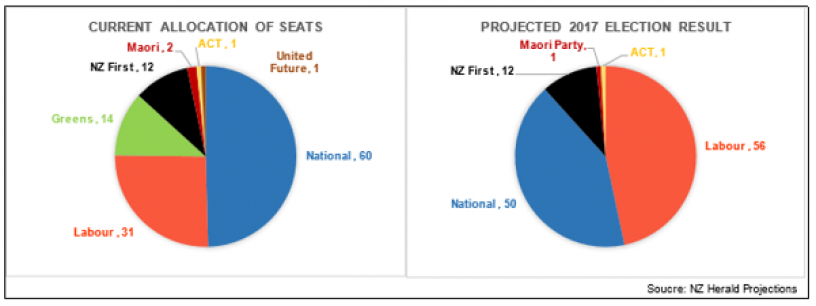

Current and projected Election Results (NZ Herald Projections)

[1] Harbour Navigator, NZ election: Down to the No. 8 wire, Harbour Asset Management, 31/8/17.

[2] “Down to the Wire”, The Impact of the NZ Election on Risk Assets, First NZ Capital, 11/9/17.

Impact of Elections on the NZ Share-market

Outside the strong stock-market rally in 1993, which was a recovery period after years of recessions, general elections tend not to have a huge impact on NZ shares either right before or after a change in Prime Minister, (see charts below).[3]

[3] Booster Investment Services, Adviser Update, September 2017.

Clear your schedule for this Saturday morning and make sure you get out and vote! Every vote counts, especially from our younger voters.

Only 47% of the eligible voters between the ages of 18-29 voted in the 2014 General Elections, whereas 87% of people over 65 voted. Research has indicated that the reason the younger voters did not vote was both a lack of information about political parties / what they stand for and a lack of understanding of the Government’s importance and relevance.

For those voters that need a little help deciding, the following website might be of some assistance: http://www.onthefence.co.nz/

Stand up and be counted!

Lifetime Book Club: Die With Zero by Bill Perkins

“The goal is not to die with the most money, but to live the richest life.”

That is the central idea of Die With Zero. From the start, Perkins makes it clear this is not a book about saving, investing, or retiring early. It is about using money, time, and health to create a meaningful life now, not someday.

The Rise of Ethical Investing

Ethical investment, also known as Socially Responsible or ESG (Environmental, Social, Governance) investment, is about putting your money where your values are. These investments allow you to support companies and industries that aim to make a positive impact, whether that’s reducing carbon emissions, promoting fair treatment of workers, or driving social change.