Free lunch? Make sure you get yours

In today’s busy and complicated world, there are not too many free lunches available but if you look carefully, you may be able to find one!

I would consider KiwiSaver member tax credits as close to a free lunch as you can get. For those KiwiSaver investors between the ages of 18 and 64 and who contribute at least $1,042.86 to their KiwiSaver account for the year ending 30th June, the Government will give them $521 as a member tax credit each year. Translated into English, if you have contributed at least $1,042.86 into your KiwiSaver account during the year, the Government will transfer $521 cash, into your account. That’s it!

KiwiSaver accounts are locked-in until you reach the age of eligibility for New Zealand Superannuation (currently 65) or completing five years’ membership if you joined after age 60 – you will also enjoy member tax credits during these five years

The Government will give you 50 cents for every dollar you contribute up to $521, so it makes a lot of sense to ensure you have contributed enough to maximise your benefit. The government will do this for you each year. To maximise these tax credits and contribute the $1,042.86 amount, an investor would only have to contribute $20.06 per week. Most providers recommend you top up by the 25th June, to allow for processing.

Unfortunately, not all KiwiSaver members are taking advantage of this opportunity. Some of the large banks have indicated last year that only around 50-55% of their KiwiSaver members are getting the maximum benefit. That’s about $400 million that Kiwis are missing out on.

How do the numbers stack up?

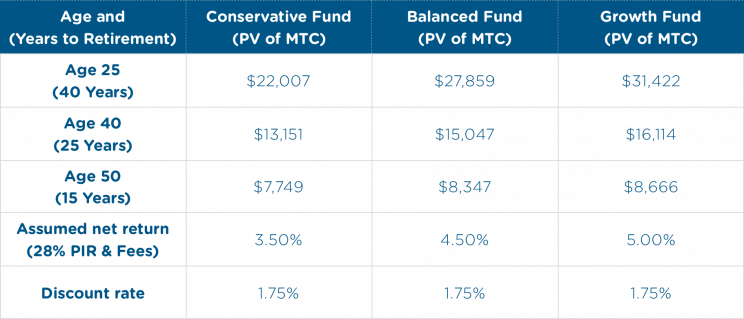

Table 1. Here are the present values (today’s dollars) for just the government’s $521-member tax credit (MTC) over different working careers and retiring at age 65 (i.e. years-to-retirement).

Chart 1. Growth of $10,000 Chart (with employee, employer and government contributions)

Chart 1 assumptions: Growth of $10,000 invested in a KiwiSaver Balanced Fund at age 40 with 25 years of investing to the retirement age of 65, employee and employer contributing 3%, $75,000 annual salary, 2% assumed inflation, 28% PIE tax rate, investment management fees of 1.20% and receiving the full $521-member tax credit.

Will you receive your full entitlement of $521? If not, you should consider topping up your KiwiSaver account today (you have until the end of June).

Enjoy your ‘free’ lunch!

Give your financial adviser a call if you have any questions on this and or if you need any advice or help making lump sum contributions to your KiwiSaver account.

KiwiSaver is changing

Budget 2025 has introduced some significant updates to KiwiSaver. These changes are aimed at ensuring the scheme remains sustainable while helping New Zealanders grow their retirement savings. Whether you are just starting out, nearing retirement, or somewhere in between, here's what you need to know and how it might affect your financial plans.

Lifetime Book Club: Four Thousand Weeks by Oliver Burkeman

In a world obsessed with productivity hacks, endless to-do lists and squeezing more out of every day, Burkeman offers something radical: acceptance. Not of defeat – but of reality. Because when you really look at it, four thousand weeks (roughly 80 years) is all we’ve got. And no app or bullet journal is going to give us more.