Booster Client Update - Market volatility, a friend to the long-term investor?

We mentioned a couple of updates ago that more ‘normal’ volatility has returned to markets so far in 2018. This can be unsettling to investors as they can start to worry about the value of their portfolios. However, volatility actually provides very valuable opportunities to the long-term investor. History tells us that markets always go up over the long-term, so when they have small dips, this is a bit like the market having a sale! Warren Buffett, one of the world’s most successful investors, once said “whether we’re talking about socks or stocks, I like buying quality merchandise when it is marked down”. One way of systematically taking advantage of these market ‘sale’ opportunities is through something called “dollar cost averaging”.

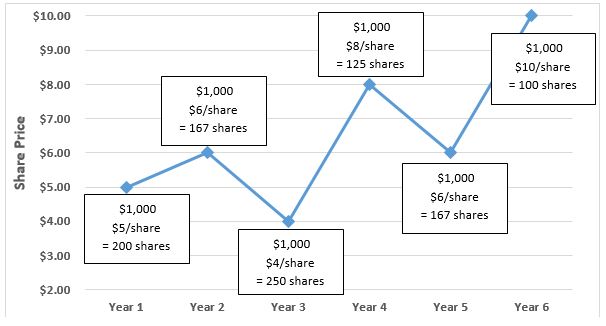

Let’s take a look at a quick example to illustrate this. The chart above shows a company’s share price over time. As you can see it fluctuates between years, but over the six years the price goes from $5 to $10. Each of the boxes shows the number of shares you can buy if you invest $1,000 each year. As you can see, in year 3 when the price is at its lowest, you can purchase the largest number of shares. At the end of the year 6 you finish with a value of $10,090 (1,009 shares @$10 per share). If you compare this to a scenario of no volatility, where the share price moves in a straight line from $5 in year 1 to $10 in year 6 and you invested the same $1,000 each year, the value you finish with is only $8,460 (846 shares @$10 per share). That’s 16% less than if there are dips in the share price along the way. Moral of the story – having a structured approach and regular contributions can help turn short term volatility to your long term advantage!

Lifetime Book Club: Die With Zero by Bill Perkins

“The goal is not to die with the most money, but to live the richest life.”

That is the central idea of Die With Zero. From the start, Perkins makes it clear this is not a book about saving, investing, or retiring early. It is about using money, time, and health to create a meaningful life now, not someday.

The Rise of Ethical Investing

Ethical investment, also known as Socially Responsible or ESG (Environmental, Social, Governance) investment, is about putting your money where your values are. These investments allow you to support companies and industries that aim to make a positive impact, whether that’s reducing carbon emissions, promoting fair treatment of workers, or driving social change.