Booster Client Update - Market volatility, a friend to the long-term investor?

We mentioned a couple of updates ago that more ‘normal’ volatility has returned to markets so far in 2018. This can be unsettling to investors as they can start to worry about the value of their portfolios. However, volatility actually provides very valuable opportunities to the long-term investor. History tells us that markets always go up over the long-term, so when they have small dips, this is a bit like the market having a sale! Warren Buffett, one of the world’s most successful investors, once said “whether we’re talking about socks or stocks, I like buying quality merchandise when it is marked down”. One way of systematically taking advantage of these market ‘sale’ opportunities is through something called “dollar cost averaging”.

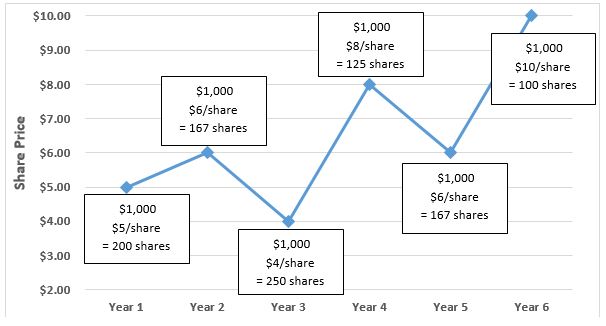

Let’s take a look at a quick example to illustrate this. The chart above shows a company’s share price over time. As you can see it fluctuates between years, but over the six years the price goes from $5 to $10. Each of the boxes shows the number of shares you can buy if you invest $1,000 each year. As you can see, in year 3 when the price is at its lowest, you can purchase the largest number of shares. At the end of the year 6 you finish with a value of $10,090 (1,009 shares @$10 per share). If you compare this to a scenario of no volatility, where the share price moves in a straight line from $5 in year 1 to $10 in year 6 and you invested the same $1,000 each year, the value you finish with is only $8,460 (846 shares @$10 per share). That’s 16% less than if there are dips in the share price along the way. Moral of the story – having a structured approach and regular contributions can help turn short term volatility to your long term advantage!

Maximise Your Miles: Financial Tips for Frequent Flyers

Whether you’re a young Kiwi planning your OE (overseas experience), a family about to embark on that long-awaited trip to Disneyland, or a seasoned business traveller hopping between meetings in Singapore and Sydney, the excitement of travel is unbeatable. But with every adventure comes a bit of financial planning to ensure your holiday memories aren’t clouded by an unexpected hit to the wallet.

Market & Portfolio Update - January 2026

After strong gains in 2025, the global share market (represented by the MSCI World Gross Index) took a breather in January, returning 0.1% in NZ dollar terms. While the ‘Magnificent 7’ (the seven largest US-listed companies, including Google, Microsoft & Apple) have been large drivers behind the recent gains seen from the US share market, January told a different story. There appeared to be ‘catch-up’ trade where investors moved out of concentrated tech positions and into the rest of the market, with the Russell 2000 index (a widely regarded proxy for smaller US companies) having a strong month. This was generally seen as improving confidence in the broader US economy.