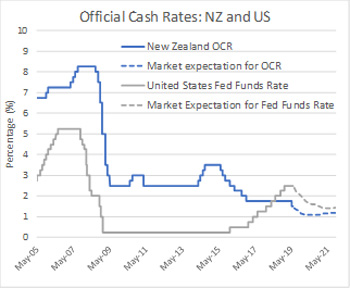

All-time Low for Cash Rates

It is an age-old question: What are interest rates going to do? The answer to this question influences decisions for investors and borrowers alike. The chart below shows NZ and US official cash rates (OCR) as set by their respective central banks. After staying the same for two and a half years, the NZ OCR has now fallen to a new record low of 1.5%, as the Reserve Bank has responded to weakening global economic growth prospects and inflation pressures appearing to have eased off for now. Compare this with the US rate, which has been lifted nine times since 2016 - although we may now have seen the last hike of this cycle. As a result, this is the first time that the US rate has been above the NZ rate since our OCR was launched in 1999!

This is good news for New Zealanders with mortgages and businesses looking to borrow, which lends some support to economic growth. For savers low rates is not so good news, but at least New Zealand’s rates remain well above those in most other developed countries around the world especially Europe, where official cash rates are still stubbornly negative.

What does this mean for how we manage your money?

For most investors, fixed interest investments (such as bonds) still play a very important role in smoothing the occasional volatility (ups and downs) that comes from investing in shares. This is because bonds rise in price when market interest rates fall (as their existing income yield becomes more attractive compared to the new lower market rates) – and this tends to happen when economic growth, and shares, are weaker.

Thinking outside the box.

Today’s lower rates (and those of the last decade) create the challenge of sustaining the levels of investment income you have come to expect. This has been a key factor supporting Lifetime’s development of our Income Focus portfolios. But just to be clear, in order to outperform term deposits, investors must increase their investment risk. It is like a sliding scale, if you want 4% return then X amount of risk, or 5% return then XX risk, etc. etc.

We have a series of income focused portfolios that invest in a combination of high-quality New Zealand corporate bonds and higher yielding NZ shares. The amount of NZ shares depends on the investors’ desired risk profile. A well-diversified conservative portfolio is also a viable option if investors are looking to or need to outperform term deposits while insisting on a low volatility, well-diversified portfolio that can deliver a regular fortnightly withdrawal payment into their bank account. These types of portfolios will help sustain investment income, despite the new low interest era that we now appear to be in.

It appears low interest rates are here to stay, for at least a while anyway, so if the low interest rates have impacted your income and you would like to speak to an adviser to see if they can show you some alternative options, please give us a call.

Today’s lower rates (and those of the last decade) create the challenge of sustaining the levels of investment income you have come to expect.

Article by Joe Byrne, BA, AFA - Read More

Disclaimer: This article has been prepared for the purpose of providing general information, without taking into consideration any particular investor’s objectives, financial situation or needs. Any opinions contained in it are held as at the report date and are subject to change without notice. This document is solely for the use of the party to whom it is provided.

KiwiSaver is changing

Budget 2025 has introduced some significant updates to KiwiSaver. These changes are aimed at ensuring the scheme remains sustainable while helping New Zealanders grow their retirement savings. Whether you are just starting out, nearing retirement, or somewhere in between, here's what you need to know and how it might affect your financial plans.

Lifetime Book Club: Four Thousand Weeks by Oliver Burkeman

In a world obsessed with productivity hacks, endless to-do lists and squeezing more out of every day, Burkeman offers something radical: acceptance. Not of defeat – but of reality. Because when you really look at it, four thousand weeks (roughly 80 years) is all we’ve got. And no app or bullet journal is going to give us more.