Which is better? 8% Gross Yield or 5.5%

It might sound like a really silly question, but which is better?

Higher Yield – Tokoroa Property, 8% Gross Yield

First property I could find in Tokoroa on Realestate.co.nz was 176 Balmoral Drive.

On the market for $229,000.

Currently tenanted $280 pw.

That’s a 6% yield based on 50 weeks. But say you could wave your magic wand, and buy it for $175,000. Now that’s an 8% Gross Yield!

Would you buy it?

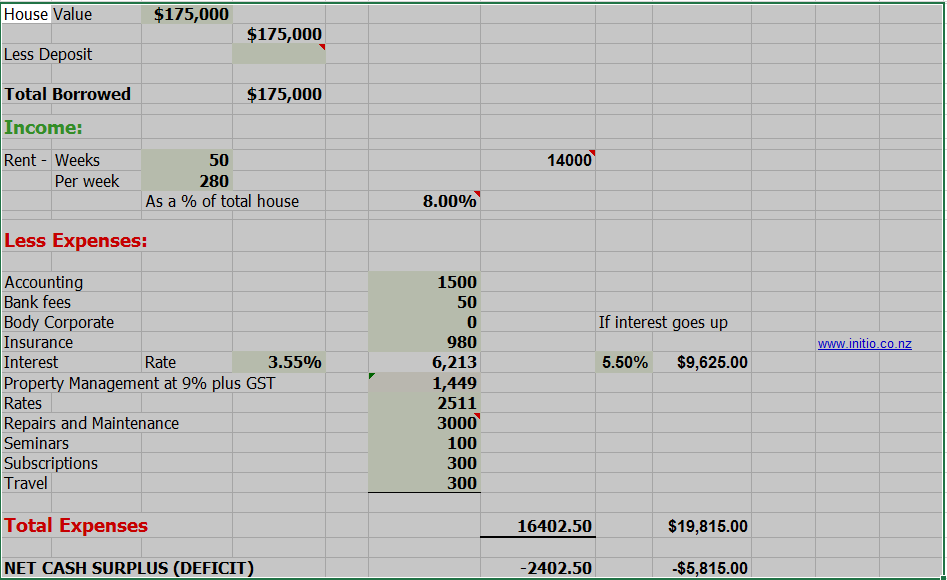

The full figures are below, but it loses $2,402.50 per year! Would you still buy it?

Lower Yield – Hamilton Property, 5.5% Gross Yield

First property I could find in Hamilton on Realestate.co.nz was 3/60 Wellington st.

On the market for $619,000.

Currently tenanted $660 pw.

That’s a 5.5% yield based on 52 weeks.

Would you buy it?

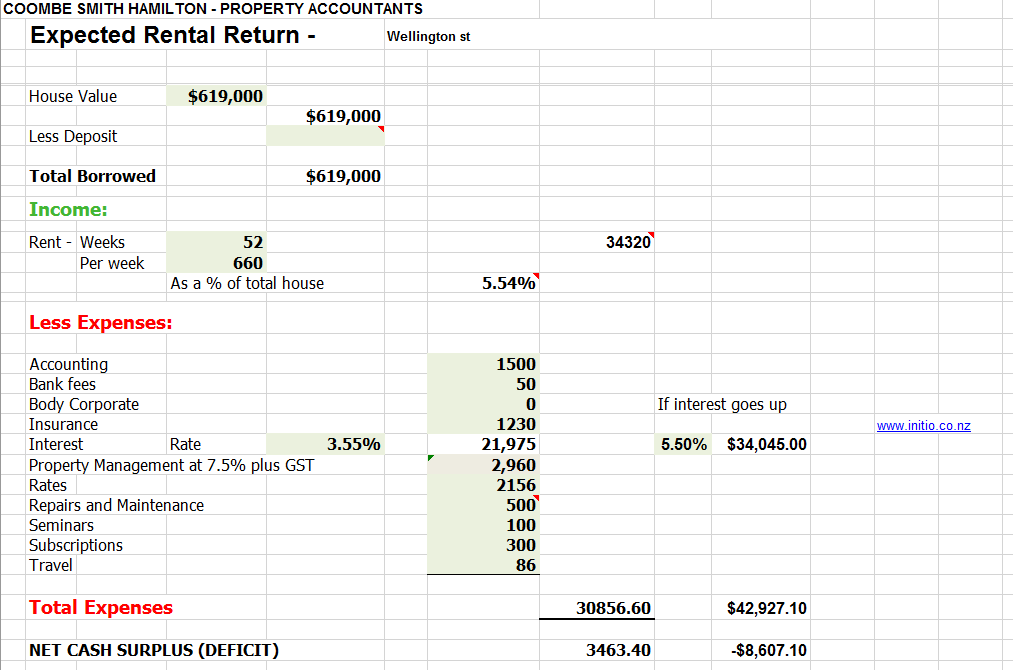

The full figures are below, but it makes $3,463.40 positive cashflow per year!

OVERALL GROSS YIELD AND LOCATION

Gross Yield is a great tool for comparing properties in the same location. But be careful with different locations. If one location has low rent, a high Gross yield property can still be negative cashflow!

So make sure you work out and review the full cashflow for any investment you are looking to buy!

In this example, the cashflow on the 5.5% newer property in Hamilton is a lot better than the 8% older property in Tokoroa.

NOTE – this doesn’t mean I would buy either!

I hope you have found this useful

Kind regards

Ross Barnett

Property Accountant | New Zealand

KiwiSaver is changing

Budget 2025 has introduced some significant updates to KiwiSaver. These changes are aimed at ensuring the scheme remains sustainable while helping New Zealanders grow their retirement savings. Whether you are just starting out, nearing retirement, or somewhere in between, here's what you need to know and how it might affect your financial plans.

Lifetime Book Club: Four Thousand Weeks by Oliver Burkeman

In a world obsessed with productivity hacks, endless to-do lists and squeezing more out of every day, Burkeman offers something radical: acceptance. Not of defeat – but of reality. Because when you really look at it, four thousand weeks (roughly 80 years) is all we’ve got. And no app or bullet journal is going to give us more.