Sam's Top Tips In A Market Shock

Sam's Top Tips In A Market Shock

1. Risk Logic

The human brain is unfortunately proven to be inept at quantifying risk and acting accordingly. We see it every day; we are more scared of a shark attack than we are of driving to the beach, but the risk is in driving not swimming.

2. Hold Middle Ground

People often are over concerned or not concerned enough, as we are wired for full fight and flight, or doing nothing. Doing something in between is the hard bit.

3. Beware Bias

Be wary of confirmation bias. This is a common psychological concept. We get an idea based on fear or overconfidence then unconsciously seek out what confirms that.

4. Check Your Sources

Review the source of your information. Do they have the right agenda? Unfortunately, our click bait world can explain why the human response to coronavirus is out of proportion to previous scares.

5. Learn

Humankind, and by extension economies, get growth from this type of adversity. A whole generation of savers came out of the great depression perhaps a generation of people with better hygiene practices will come out of this event.

6. Diversify

Life doesn’t stop, it changes. Subscriptions in Netflix increases but cruise trips fall. This has occurred time and time again in history - it is why we diversify as we can’t predict these events.

7. Keep Perspective

Don’t ignore other risks. Economically the lack of rain is a bigger cost to New Zealand at the moment but that’s not front page. Keep doing rain dances while coughing into your elbow.

8. Safe As Houses?

Don’t think your property is immune. New Zealand is an economy based on agriculture and tourism, both are badly affected if our economy is hurting, it is just a matter of time till the property market is impacted.

9. Prepare Smart

Do something to be ready. Ensure you have enough medication, invest in cheap stocks, check you have adequate insurances; call your financial adviser.

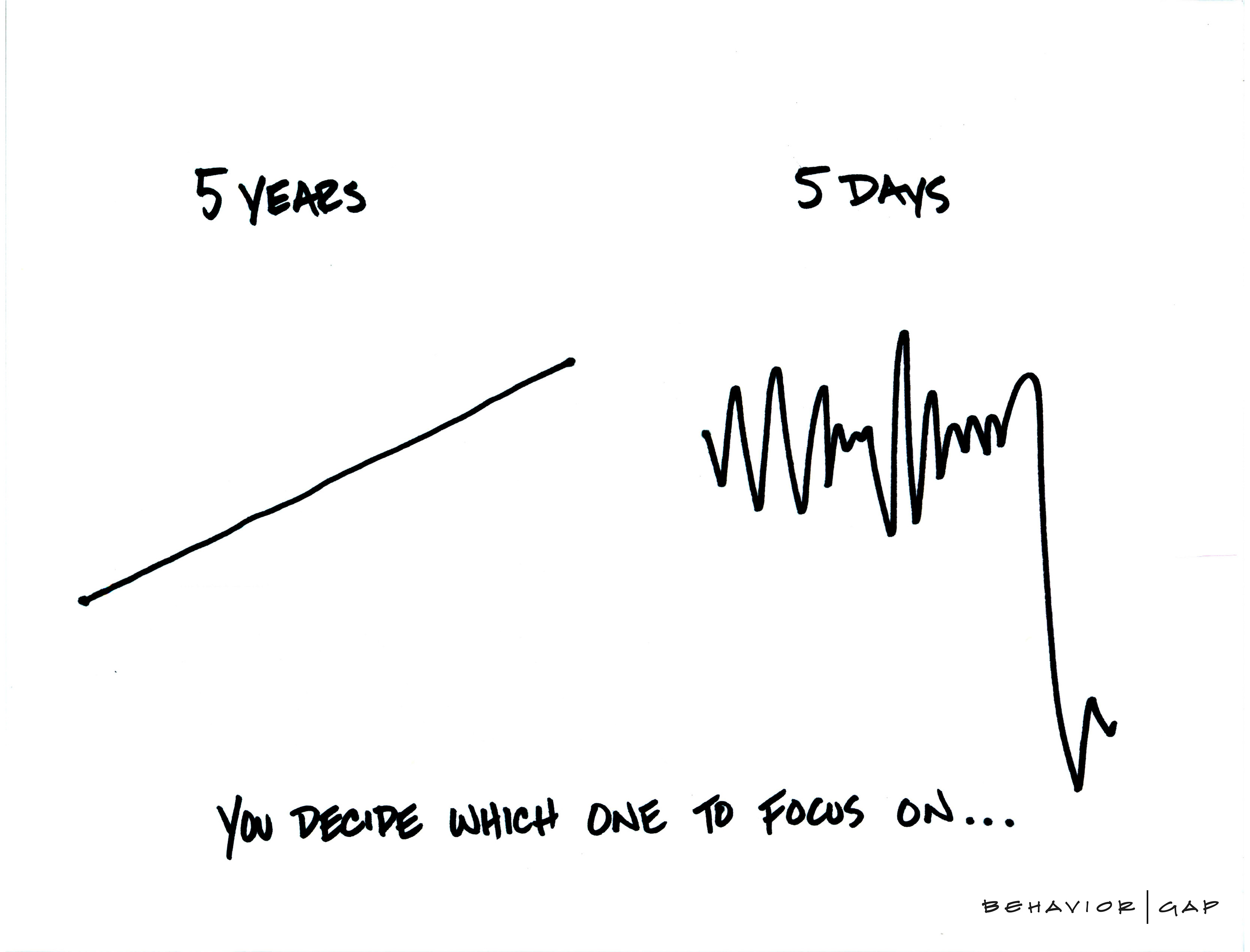

10. Check The Plan

Check your financial plan. Did it allow for big market/life shocks like this? It should have and most likely it had a long-term perspective that is required in a time like this. If it didn’t it needs amending.

11. Trial It

Have a dry run. Spend all weekend without leaving the house and iron out anything that doesn’t work. We do this all the time for people preparing for retirement - how can you improve something you don’t know about?

12. Liquidity

Where is your liquidity? If assets get super cheap or cash is king in a time of panic will you be able to get your hands-on funds to take advantage or pay bills? Remember we always advise you have three months of expenses available in cash or redraw.

13. Travel Insurance

Get an expert to help with your travel insurance. Our partners Rothbury are following the travel insurance market closely.

14. Carpe Diem

Life always has risk it’s just our awareness of those risks that changes or the emphasis we put on them. The trip of a lifetime has risks and yes, they just got greater but there is also the risk you won’t get to do it again due to any number of other reasons. Sometimes it’s harder to seize the day and live a great life!

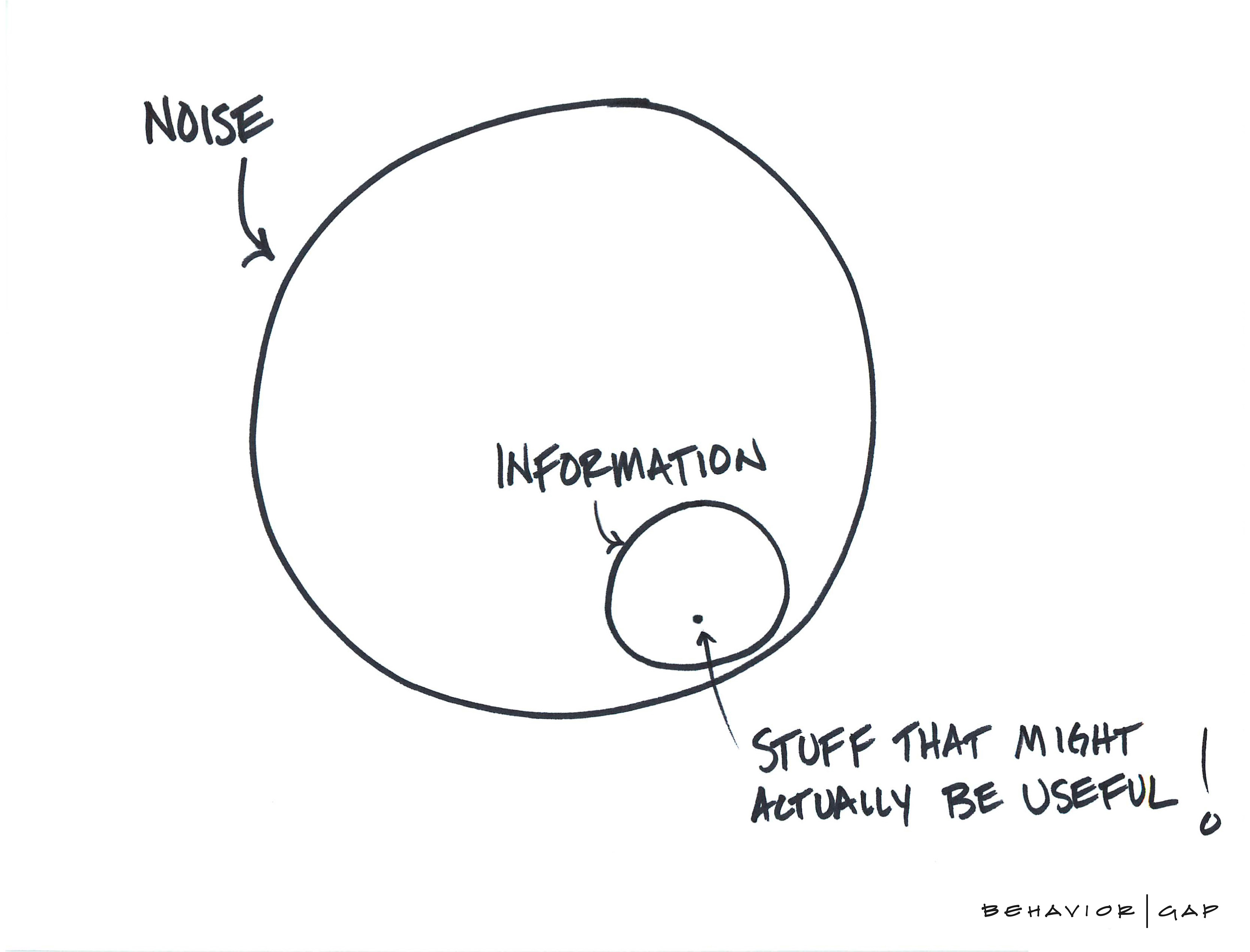

15. Filter The Noise

Don’t listen to ill-informed opinions. Would you get a good friend (who wasn’t a surgeon) to operate on you? Then don’t ask them about important stuff like your health, travel or wealth management.

Article By Sam Walter - Read More

About the Author

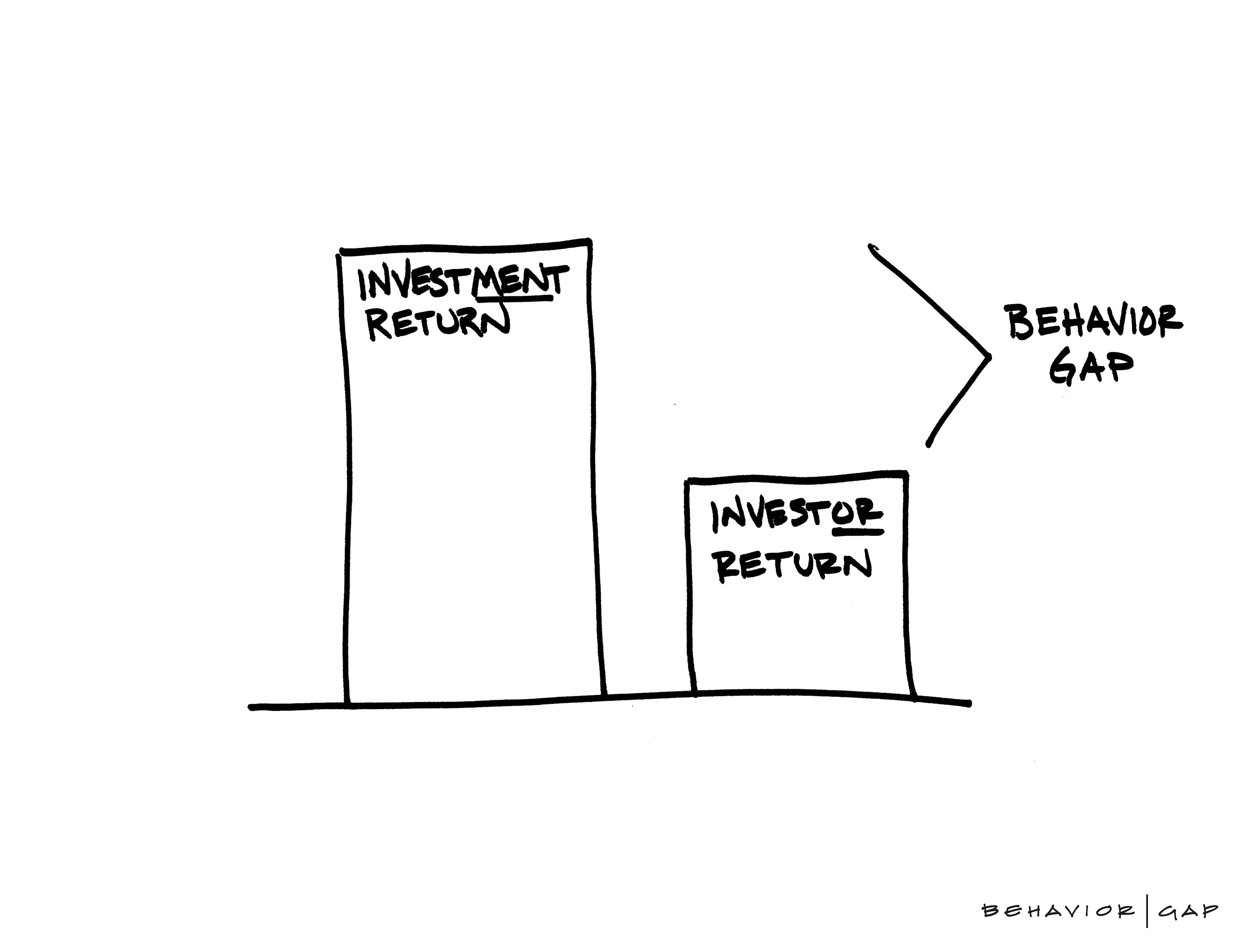

Sam Walter is an Auckland based Financial Adviser who has been supporting clients with their insurances and investments for nearly 20 years. Sam has over $90 million worth of private funds under his management and is great at motivating people to improve their financial behaviours.

How to Teach Kids About Money: Building Financial Literacy from an Early Age

As parents, we all want our children to grow up confident and capable, especially when it comes to managing their money. Financial literacy is a crucial life skill that’s best nurtured from a young age. Here are some practical tips to help your kids understand the value of money and develop healthy financial habits.

Lifetime Book Club: The Rules of Wealth by Richard Templar

Hello and welcome to another edition of the Lifetime Book Club! This month, we’re exploring The Rules of Wealth by Richard Templar, a guide that lays down the principles for achieving financial success in an accessible and engaging way.