How does Lifetime safeguard your investment assets?

When you invest in the Lifetime Discretionary Investment Management Service (DIMS) your investments are managed by a professional Fund Manager, but your actual assets are held by a separate Custodian. It is the Custodian’s job to safeguard your assets and hold them in bare trust for your benefit. This means that if there are any financial problems with the Fund Manager, your investments are ring-fenced in a separate legal entity.

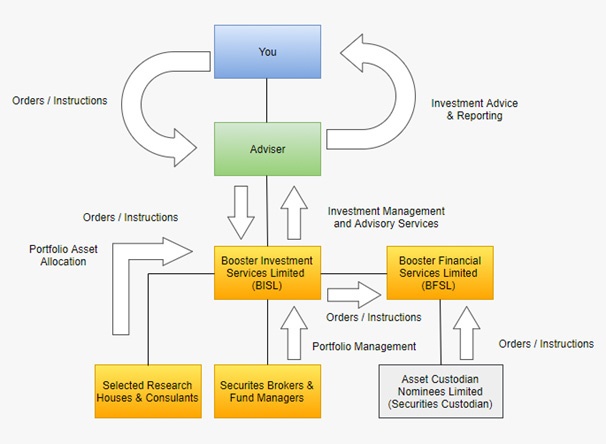

The chart below explains the structure of the custodial relationship for one of our DIMS offerings. Asset Custodian Nominees Limited, (ACNL) a separate legal company, is the custodian appointed by Booster and is separate from the fund manager.

The custodian structure below was vetted by the Financial Market Authority during our DIMS Licence application process.

The role of a Custodian

Custody means holding your investment assets in bare trust for your benefit. Asset Custodian Nominees Limited (ACNL) in this example, is the entity that holds the investment assets on your behalf in trust and is a related company of Booster. This means that these assets will be recorded on any registers in the name of ACNL. No investment assets will be held in your name, but you retain full beneficial ownership of those assets at all times, and may withdraw, transfer out, or sell down these assets at any time subject to your client agreement with Lifetime, the laws of New Zealand, and any other applicable regulations. You do this by giving instructions to your financial adviser, who then passes on those instructions to Booster.

The specific duties and responsibilities of the custodian are to:

- Maintain separate accounts for all investors;

- Value the holdings;

- Collect all income and dividends owed to the portfolio;

- Settle all transactions initiated by proper instructions;

- Provide annual tax reporting and periodic reports detailing transactions, cash flows, performance and current value of investment securities held.

Additional Custodian details1

- Clients authorise Lifetime to appoint, and / or remove an independent Custodian to hold money and securities on your behalf, and / or engage any third party to appoint and replace an independent Custodian for the Lifetime DIMS, as contemplated in the Service Disclosure Statement.

- In the Booster Platform Service, there is an agreement between Booster Financial Services Limited and the Custodian, ACNL. That agreement also contains the terms on which Booster can terminate the current custodial agreement. If Booster terminates the current custodial agreement, they would appoint a new custodian that they consider would meet its and Lifetime’s legal obligations, without interrupting the continuity of the Lifetime DIMS. In this event, your Portfolio would not be impacted.

- Lifetime will not hold any money or Securities on your behalf and any transactions or transfers of funds will only be carried out by the Custodian acting as bare trustee for you.

- Your Client Agreement will not be deemed to terminate solely as a result of any change in the Custodian or because at any time no money and / or Securities are held on your behalf by the Custodian.

- The Custodian is required to send you directly a range of reports on a six-monthly basis, in accordance with regulation 5 of the Financial Advisers (Custodians of FMCA Financial Products) Regulations 2014.

Testing of the Custodian’s Internal Controls

Booster is independently audited by Grant Thornton on an annual basis. This includes Grant Thornton obtaining sufficient, relevant and reliable audit evidence to enable them to issue opinions of the truth and fairness of the financial statements of Booster.

Booster also undertakes an annual review of the effectiveness of its internal controls. This is also carried out by Grant Thornton and is prepared in accordance with the International Standard on Assurance Engagements (ISAE) (NZ) 3402 and Explanatory Guide (EG) Au8 – Audit Implications of the Use of Service Organisations for Investment Management Services.

Conclusion

In recent years, there has been increased regulation regarding custodians and how they interact with investors, all with the intention of making investing safer for investors.

As always, if you have any questions on this or any financial matter, please contact your financial adviser.

Article by Joe Byrne, BA, AFA - Read More

1As per our DIMS Client Adviser Agreement.

Disclaimer: This article has been prepared for the purpose of providing general information, without taking into consideration any particular investor’s objectives, financial situation or needs. Any opinions contained in it are held as at the report date and are subject to change without notice. This document is solely for the use of the party to whom it is provided.

How to Teach Kids About Money: Building Financial Literacy from an Early Age

As parents, we all want our children to grow up confident and capable, especially when it comes to managing their money. Financial literacy is a crucial life skill that’s best nurtured from a young age. Here are some practical tips to help your kids understand the value of money and develop healthy financial habits.

Lifetime Book Club: The Rules of Wealth by Richard Templar

Hello and welcome to another edition of the Lifetime Book Club! This month, we’re exploring The Rules of Wealth by Richard Templar, a guide that lays down the principles for achieving financial success in an accessible and engaging way.