Which is better? 8% Gross Yield or 5.5%

It might sound like a really silly question, but which is better?

Higher Yield – Tokoroa Property, 8% Gross Yield

First property I could find in Tokoroa on Realestate.co.nz was 176 Balmoral Drive.

On the market for $229,000.

Currently tenanted $280 pw.

That’s a 6% yield based on 50 weeks. But say you could wave your magic wand, and buy it for $175,000. Now that’s an 8% Gross Yield!

Would you buy it?

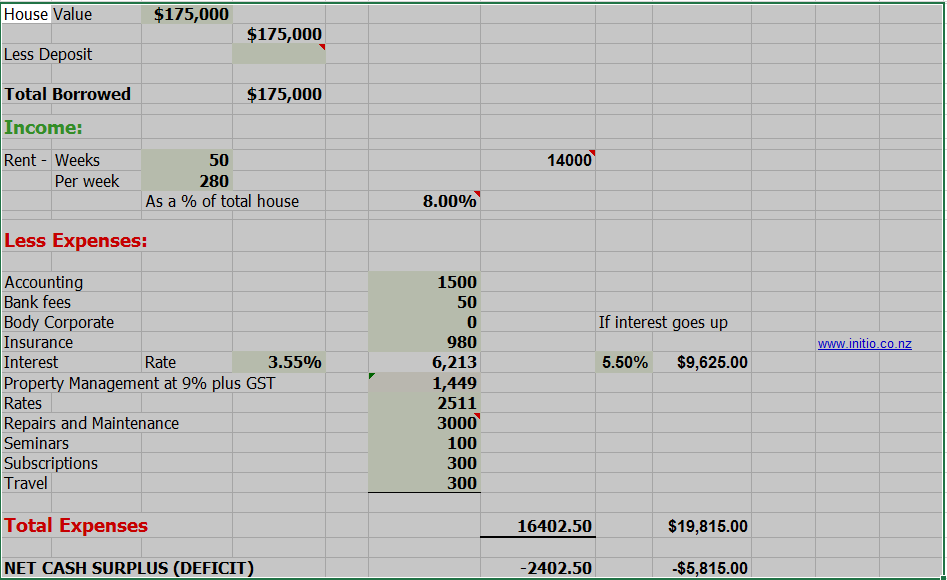

The full figures are below, but it loses $2,402.50 per year! Would you still buy it?

Lower Yield – Hamilton Property, 5.5% Gross Yield

First property I could find in Hamilton on Realestate.co.nz was 3/60 Wellington st.

On the market for $619,000.

Currently tenanted $660 pw.

That’s a 5.5% yield based on 52 weeks.

Would you buy it?

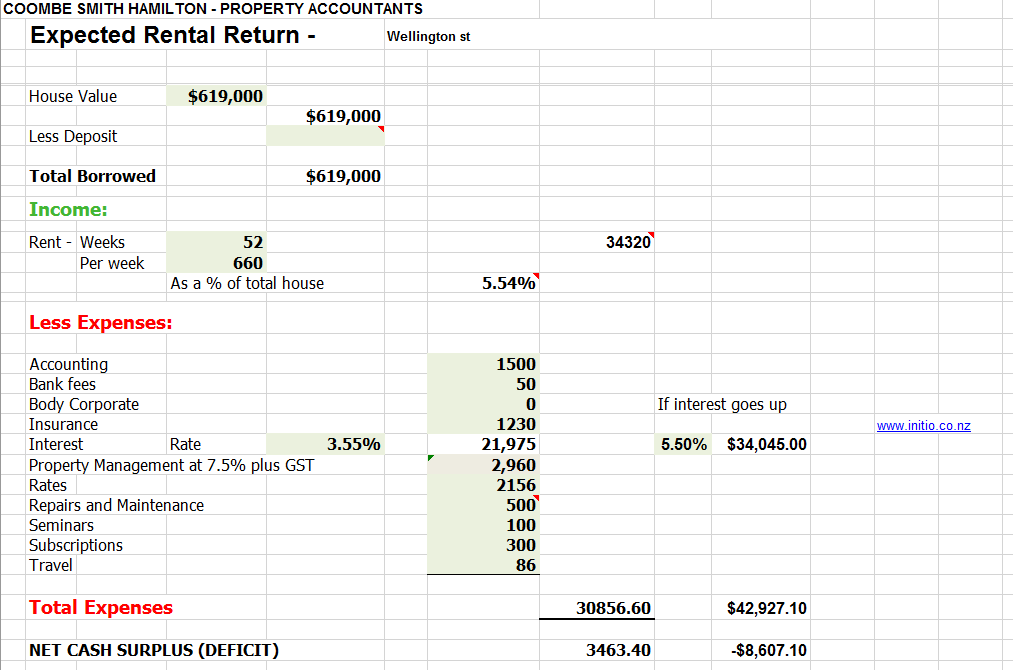

The full figures are below, but it makes $3,463.40 positive cashflow per year!

OVERALL GROSS YIELD AND LOCATION

Gross Yield is a great tool for comparing properties in the same location. But be careful with different locations. If one location has low rent, a high Gross yield property can still be negative cashflow!

So make sure you work out and review the full cashflow for any investment you are looking to buy!

In this example, the cashflow on the 5.5% newer property in Hamilton is a lot better than the 8% older property in Tokoroa.

NOTE – this doesn’t mean I would buy either!

I hope you have found this useful

Kind regards

Ross Barnett

Property Accountant | New Zealand

Lifetime Book Club: The Almanack of Naval Ravikant by Eric Jorgenson

In a world that often confuses busyness with success and income with wealth, this book offers a different perspective. One that suggests true wealth is freedom. Freedom over your time. Freedom over your decisions. Freedom to live life on your own terms.

Maximise Your Miles: Financial Tips for Frequent Flyers

Whether you’re a young Kiwi planning your OE (overseas experience), a family about to embark on that long-awaited trip to Disneyland, or a seasoned business traveller hopping between meetings in Singapore and Sydney, the excitement of travel is unbeatable. But with every adventure comes a bit of financial planning to ensure your holiday memories aren’t clouded by an unexpected hit to the wallet.